RNFI Services Ltd. Result - Announces Exceptional Half-Yearly Performance

Nov 18, 2024

VMPL

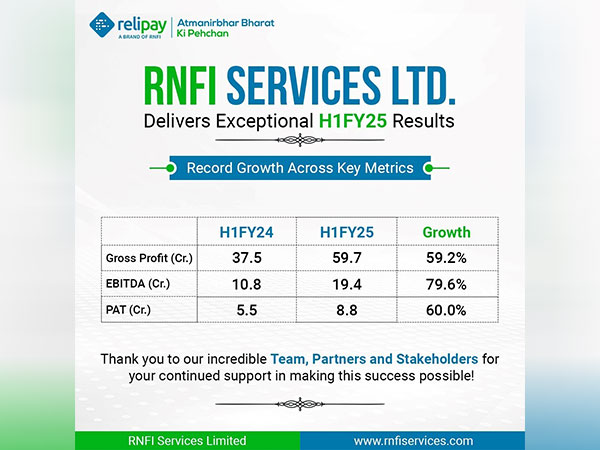

New Delhi [India], November 18: RNFI Services Ltd., a leading player in the fintech space has reported stellar performance for the first half of FY25, delivering results that exceeded expectations. Despite challenging market conditions, the company has shown impressive growth across key financial metrics, positioning itself strongly for the future.

Key Highlights:

* Gross Profit surged by a remarkable 59.2%, rising from Rs37.5 Crore in H1FY24 to Rs59.7 Crore in H1FY25.

* EBITDA witnessed an outstanding growth of 79.6%, moving from Rs10.8 Crore in H1FY24 to Rs19.4 Crore in H1FY25.

* PAT grew by an impressive 60%, increasing from Rs5.5 Crore in H1FY24 to Rs8.8 Crore in H1FY25.

Revenue Performance:

While overall Revenue experienced a slight decline of 13.1% (from Rs527.2 Crore in H1FY24 to Rs458.1 Crore in H1FY25) primarily due to a reduction in forex business, Non-Forex Revenue grew strongly by 50.5%, rising from Rs137.5 Crore in H1FY24 to Rs206.9 Crore in H1FY25. This strategic shift towards more profitable, sustainable revenue streams is a testament to RNFI's forward-thinking approach.

Strategic Growth in Retailer and Financial Institution Base:

- The Average Revenue per Retailer has increased significantly from Rs853 in FY24 to Rs1,278 in H1FY25, reflecting the strong value that RNFI provides to its partners.

- The number of active retailers has grown from 1.41 Lac in FY24 to 1.7 Lac in H1FY25, showcasing expanding reach and demand for RNFI's services.

- RNFI's growing network of financial institutions is also a key highlight. The company now works with 70 financial institutions (up from 54 in FY24), including 7 private sector banks, 6 public sector banks, 4 small finance banks, 3 payment banks, 29 NBFCs, 12 MFIs and 9 other financial entities.

Outlook:

RNFI Services Ltd.'s strong financial performance and strategic shifts highlight its resilient growth trajectory. The company's focus on scaling its non-forex revenue streams and strengthening relationships with financial institutions positions it well for continued success in the coming months and years.

These exceptional results underscore RNFI's ability to innovate, adapt and deliver sustainable growth in an increasingly competitive fintech landscape.

Stay tuned for more updates as RNFI continues to redefine the future of financial services!

Links

https://www.linkedin.com/company/rnfiservicesofficial/posts/

https://www.rnfiservices.com/

(ADVERTORIAL DISCLAIMER: The above press release has been provided by VMPL. ANI will not be responsible in any way for the content of the same)